Questões de Concurso Comentadas sobre inglês para instituto aocp

Foram encontradas 11 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

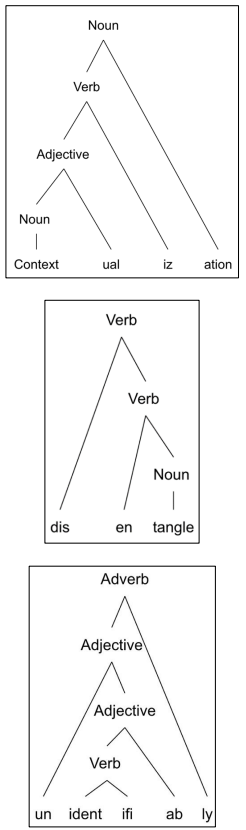

Observe the morphological process of the formation of the following words:

Now analyze the following statements.

I. -context- and -tangle- are free roots, while -ident- is a bound root.

II. These three words are formed both by prefixation and suffixation.

III. In the noun, -ual- and -iz- are derivational suffixes, while in the adverb, -ifi- and -ab- are inflectional suffixes.

IV. dis- and en- both have negative meanings.

V. The head of the noun is -ation, the head of the verb is en- and the head of the adverb is -ly.

The correct statements are

The tasks below are adapted versions of the activities, from the textbook, to work with the text. Match Tasks 1 – 6 with their main aim A – I. There are three extra aims which you do not need to use.

Tasks

Task 1 Discuss the questions in small groups.

1 Have you ever been to a job interview? How was the experience? What kind of questions did they ask you? Did you get the job?

2 What kind of questions do you expect to have in a job interview?

3 How can people get better prepared for a job interview?

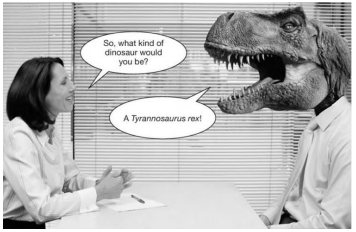

Task 2 Look at the photo with the article. What do you think is happening? Do you think the question is one that someone might really ask in this situation? Why (not)?

Task 3 Read the article once and find out. How would you answer the question?

Task 4 Look at the highlighted words and phrases in the text. With a partner, try to figure out what they might mean and how you think they are pronounced.

Task 5 Read the article again. Using your own words, answer the questions.

1 What are extreme interviews? 2 What kind of companies first started using them? 3 Why do some people think that they are better than normal interviews?

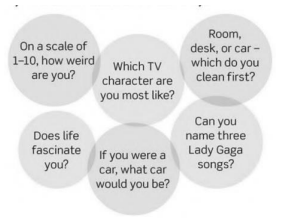

Task 6 Do you think extreme interviews are a good way of choosing candidates? Which of the questions below (used in real interviews) do you think would work well? Why?

Adapted from: Face2Face Intermediate. Cris Redston and Gillie Cunningham. Cambridge University Press.

Main Aim

A. Integrating skills and personalizing the topic. B. Analyzing text organization. C. Inferring meaning of lexis from context. D. Predicting. E. Teaching grammar inductively using the text. F. Skimming. G. Activating schemata. H. Reading for details. I. Scanning.

“Savings accounts are designed to hold money over a long period of time to help you save for larger goals (rather than everyday purchases). As your money stays in the account, it will accrue interest and grow over time. This means that you will need to visit your bank, set up a transfer online, or make an ATM withdrawal to access your money.”

I. While both allow you to access your money, you may consider it easier to do so with checking accounts (1st paragraph). II. In contrast, savings accounts have a limit on the number of withdrawals you can make each month (1st paragraph). III. Most banks won’t allow people under the age of 18 to open a checking account without a parent or legal guardian as a co-owner of the account (2nd paragraph). IV. When it comes to setting aside money for a long-term need or goal, you should consider a savings account (3rd paragraph). V. There are also dedicated savings accounts for kids, though a parent or guardian is usually required as a joint owner (4th paragraph).

Now, choose the alternative that classifies these terms correctly and matches them with an appropriate synonym.